I live in the Las Vegas area along with my wife, Felicia. I work in the Information Technology field, and this journey as a budgeting coach is the result of my desire to share my budgeting skills with others.

My mission as a budgeting coach is to help people achieve their financial goals and reduce their financial stress. My approach is not to tell you what to do with your money, but rather to help you organize your money, analyze your goals, and give you a process to follow that allows you to make decisions based on your own priorities. You can share as little or as much with me, but the more you share, the more I can help.

I have been budgeting in my personal life for over four years. Together with my wife, following the YNAB method, we have paid off more than $40,000 in credit cards and car loans. In the same period of time, we purchased our first home, handled several unexpected large bills without stress, and are saving more for retirement. In 2021 I received my YNAB Budgeting Coach certification, which means that I have the ability to competently teach YNAB to others.

My primary certification related to this budget coaching service is my YNAB budgeting certification. In addition to my budgeting certification, I have formal education from the University of California. I received my Bachelor of Science in Software Engineering and I also hold Associate’s degrees in Mathematics and Physical Science.

I first realized I needed to start budgeting as I was finishing my undergraduate degree. While in school full-time, I was also working part-time between twenty and thirty hours a week. Student loans helped cover most of my school expenses but I still had other expenses that my part-time income didn’t always cover. After graduating, budgeting became even more critical. I did not expect the large amount of taxes and retirement savings I would be paying once I entered the professional workforce, and I soon had to start paying down my student loans. In the early days, I tried budgeting with an Excel spreadsheet. It was effective, but had its limitations. The main problem was that I was projecting my income, and any changes I had would affect my budget’s accuracy.

After some internet research, I came across YNAB – You Need A Budget. It was a bit hard to wrap my head around their method at first, but due to the large amount of learning resources they provide to their community, I eventually got the hang of it. When used to its full potential, the YNAB software and method enables behavioral changes by giving you total clarity of your personal finances. After the first year, I was hooked on the method.

The real test of my new skills came as my wife (then-fiancé) asked me to help her with her own finances. I had student loan debt and she had credit card debt. Early on, we decided it was important for us to have a plan to pay off our debts if we were to get married. This endeavor is challenging enough for one person, but being fully open with each other about our personal finances was a true test of our relationship. It was difficult, but the rewards that came along with the clarity and security the budget provided was enough to overshadow the stresses of facing our debts and making changes to how we treat money.

On April 1, 2020—at the very beginning of the pandemic—my wife’s company laid off 30% of their workforce and she was one of the unlucky 30%. By this time, we had been budgeting together for about a year. We were fortunate to qualify for unemployment assistance that got us through several months until she was able to find a new job, but that event was much less stressful due to the fact that we had a safety net and we knew all our monthly expenses. We were living in Southern California at the time. While we did receive assistance from the State unemployment fund, it took two months before we received it due to the extreme pressure that was put on the system. We were able to cover all our normal expenses during those two months without adding any new debt.

In 2021, we were fortunate enough to be able to relocate for our careers, and again because of our diligent budgeting, we were able to put a down payment on our first house together. With discipline and clear financial priorities, we were able to stay on our feet during the pandemic, job changes, and an out-of-state move with minimal financial stress. We now practice budgeting together on a regular basis, and it’s safe to say that our financial life is pretty “boring”.

It was these events that solidified the importance of budgeting and financial awareness in my mind. Since then, I have helped other family members and friends to build good budgeting habits. When YNAB released their certified budget coach program, I was among the first to sign up and I look forward to helping you along your budgeting journey.

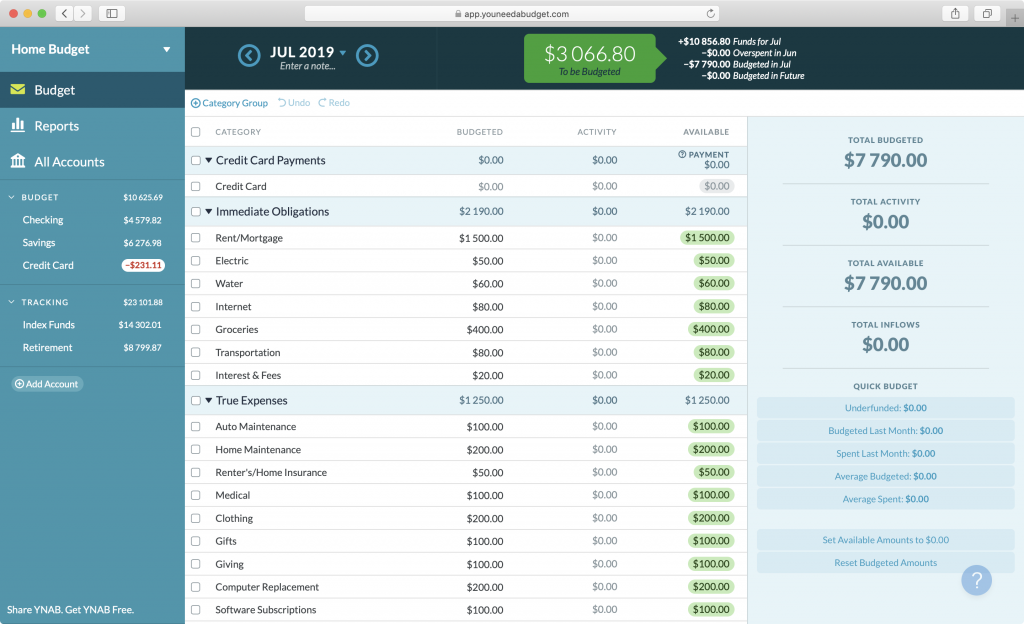

Every client is different and I may change some aspects of my coaching to fit each client, but in general, I follow the YNAB Method. For those not already familiar, YNAB (You Need A Budget) is a company that created a budgeting method and software that makes implementing that method much easier. Generally, I teach the YNAB method and software because in my experience, it is highly effective at helping individuals achieve a successful budgeting rhythm. There are many good habits of successful budgeting, but YNAB has broken it down to six major behaviors that contribute to being a successful budgeter. We call them the six habits of successful YNABers. For more information, read this post from the YNAB website. Over here at the Budgeting Base Camp, we are talking about climbing mountains, so I like to call these the “Six Peaks of Successful Budgeteering”. My goal is to help you conquer each of these peaks.

Whenever you receive money, regardless of the source, you should enter it into YNAB. We will work together on forming this habit as one of the first priorities.

Equally important to entering your hard earned money is giving all those dollars a job. In YNAB, this is “Rule One”. In our coaching sessions, I will teach you the four rules of YNAB if you’re not already familiar. Budgeting every dollar is critical for the YNAB method.

This is one of the more challenging habits to form. We will ease into this behavior over time. The YNAB software makes it easy to check your budget while on the go, but it takes time to build this into your routine.

Keeping up with transactions can also be a challenging habit to form. It is essential for maintaining an accurate budget, which in turn helps you make good financial decisions.

Frequent reconciling is important to keep on top of your budget. If you have not established a good habit of entering all your transactions daily, reconciling is the time to catch up. It can turn into a large chore if you wait too long in between reconciliations.

The true power of the YNAB method is that it’s 100% flexible to your changing priorities and lifestyle. It is inevitable that you will spend a couple months saving for something, only to realize that you want or need something else more. This is Rule Three of YNAB – Roll with the Punches.

The YNAB software is nothing less than magical. This software has been completely tuned to the YNAB method and continues to get better over time. You can access the software from your phone or the web, so no matter where you are, you’ll be able to view your budget. It even works offline and will sync any changes you do once you’re online again. It is not a requirement to use the YNAB software as part of my coaching, but I highly recommend it to all clients because it will help keep you organized, and can even make the budgeting process kind of fun! If you’re not already familiar with the software, I recommend to head over to the YNAB website, watch some informational videos and learn what it’s all about. Rest assured that I am a YNAB veteran and will help you every step of the way to becoming a YNAB pro.